The pandemic has changed the way consumers think about transport. According to a recent survey by Cox Automotive, 46% of consumers have changed their transportation habits during the global health crisis, halting their use of public transport and ride-hailing services and preferring to drive their own vehicles – 78% in 2021 versus 67% in 2018.

At the same time, they do not want an expensive commodity depreciating on their driveway. Consumers are looking for new ways to access a car beyond traditional car ownership. According to Frost & Sullivan, as awareness of new ownership models grows, consumers will be attracted to options that fit into their connected lifestyles, with subscriptions being an obvious long-term solution.

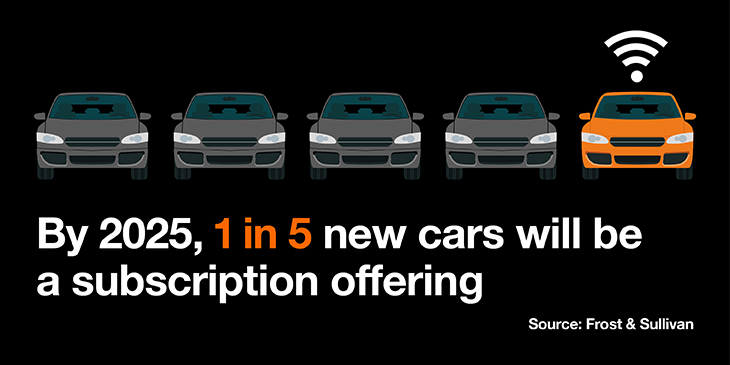

Today we have subscriptions for everything from smartphones to entertainment services. Frost & Sullivan believes cars will be the next big growth area, predicting that every 1 in 5 new cars will be a subscription offering by 2025.

The dawning of the age of car-as-a-service

Car-as-a-service is where a monthly subscription gives users access to various vehicles and solutions, adaptable to changing behaviors and expectations. It includes add-ons such as insurance and roadside assistance. The concept is designed to maximize usage for consumers and, in some cases, reduce outgoings. Cars are typically electric, thus require less maintenance than conventional vehicles, and are more energy efficient and environmentally friendly.

BMW, Mercedes, Porsche and Volvo are among the automotive brands that have launched subscription plans. Ultimately, these recurring business models help to secure the bottom line of brands and fund innovation.

Typically, the consumer benefit around vehicle subscription has been about increased flexibility and minimal commitment. However, according to a recent survey by Cox Automotive, flexibility is no longer the most important factor to consumers. Access to the best and newest in-vehicle technology is seen as the top benefit for both car subscription users (35%) and car owners (45%).

Wrapping in services to create value

We will increasingly see car makers wrap services around sales in a servitization model that gives them more control over their customers’ journeys. By limiting their contact with end customers through traditional dealerships, they realize they are missing out on potential new revenue streams and opportunities to retain customer loyalty.

Servitization enables them to sell “outcome as a service” and push subscription models rather than a one-off sale, such as maintenance and technology upgrades. Using data harvested from connected cars and the assistance of IoT, automotive companies can learn more about their customers and their behaviors and better satisfy their demands.

There will also be growth in the car-sharing model, which combines the subscription model with the pay-per-use. Car-sharing users can reserve cars by the hour or day and lock and unlock them via an app. The cars can be picked up and dropped at various locations.

Getting ahead of the curve, Lynk & Co, a global mobility brand formed as a joint venture between Geely Holding, Geely Auto Group and Volvo Car Group, has launched its “always connected” car as part of a subscription model. The vehicle uses the Internet of Things (IoT) network and infrastructure from Orange Business to deliver connected services to drivers, from the Internet and billing to infotainment.

Lynk & Co offers a subscription model for those who do not want to purchase the car outright. The vehicle incorporates a share button, enabling owners or subscribers to generate income via sharing functionalities when they are not using the vehicle. Lynk & Co members can control, monitor and share their cars from a smartphone app that communicates with the vehicles via the cloud.

“The automotive industry has continued with a distribution and ownership model that has existed for 100 years. We’re changing that. Customers today value products that reflect their digital and ever-changing lifestyle,” explains Alain Visser, Lynk, and Co-chief Executive.

Lynk & Co uses a direct-to-consumer sales model in most of its markets. Consumers can order the car online and customize it using a variety of packages or go direct to a Lynk & Co club, which is being rolled out across Europe. They are designed to be meeting places and the beating heart of the Lynk & Co community.

The emergence of digital platforms

Car-as-a-service also fits into the concept of mobility-as-a-service, where consumers can switch between different transportation modes via a single platform. It opens up the possibility of public and private transport interconnecting, helping to address environmental concerns and traffic congestion, providing more transport options for the public in urban areas.

Orange Business believes the answer to managing these services is a mobility blockchain platform to allow service providers to provide integrated and value-add services. Blockchain provides a shared, immutable ledger capable of giving trust and consensus across a mobility ecosystem.

Technology is also helping car hire companies to servitize their offerings. Hertz car rental, for example, introduced a 24-hourly rental service for its business customers across Europe utilizing Orange Business Datavenue, a modular IoT and analytics solution. The offering enables users to retrieve a rental car or van in a convenient location whenever they want, and for the duration of their choice.

The IoT connectivity provided by Orange Business allows customers to have a voice call service on board the vehicle, allowing them to make direct contact with the Hertz call center. Previously, each country had to use a local operator to provide the SIM cards, which was complex and inadequate for customers.

The Hertz pool fleets can be deployed in one or multiple countries where an enterprise customer operates, allowing staff to book and use the vehicles available from different locations. The keyless cars, available for pick up and drop off 24/7, can be booked on the phone, online or by using an app.

Driving into the future

The servitization model is the most disruptive sales model the automotive industry has seen since the Model T Ford rolled off the production line, significantly lowering the cost and commitment of owning a car. For automakers that can switch to this flexible model, there are substantial revenue potentials.

Tesla, for example, is banking on a self-drive subscription for motorists and is already offering it to those who have achieved high enough marks in its safety score. The Full Self Driving (FSD) capability costs a manageable $199 a month subscription, or an outright purchase of $10,000. A premium package is available with Smart Summon, allowing the driver to beckon their car from a tight parking spot using a Tesla app as a remote control.

Another example of servitization is battery-as-a-service. Several companies are trialing the concept where drivers swap batteries at a designated place instead of recharging. In the U.S., start-up Ample has raised $160 million for its battery swapping model, initially with commercial vehicles. In China, the standard for electric passenger vehicle-used shared battery swapping stations has just been put forward and is expected to be ratified this year. Several automakers in the country, including Geely Auto, NIO and SAIC Motor, have battery-swappable electric vehicles in production.

Automakers must read their customers

At a time when all our needs and attitudes towards car ownership are changing, subscription models provide an exciting new revenue stream for automakers. But, they will need to be careful that they balance offerings with consumer expectations, or they will see consumers hopping to the competition thanks to few tie-ins compared to traditional car leasing.

Learn more about how Orange Business is reinventing how we use vehicles with onboard connectivity that is creating new innovative services. And read about Lynk & Co’s “always on and connected” car using pan-European IoT connectivity from Orange Business.